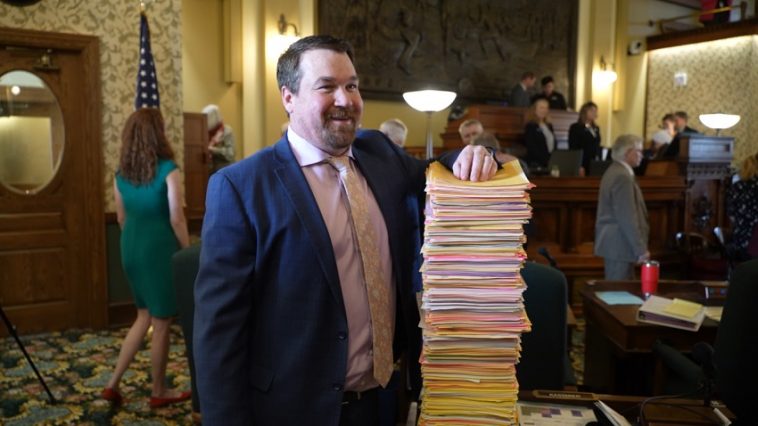

Missoula, MT— The Montana Legislature concluded its 69th session on Wednesday after 85 working days, marking the end of an eventful period filled with intense debate and significant legislative actions. As lawmakers adjourned “sine die” — meaning without a set date to return — the State Capitol saw a quick exodus, with many legislators packing up their desks and heading out hours after the session officially ended.

The final day began with the House of Representatives convening at 9 a.m., with House Bill 231 taking center stage. This bill, which addresses property taxes, was part of a larger package of legislation aimed at revising Montana’s property tax system. It was closely linked with Senate Bill 542, which had already been passed by the Senate and was not revisited by the House due to a conference committee’s decision to leave the bill unchanged.

If signed into law, both bills would establish “homestead” tax rates, offering reductions for primary residences, long-term rentals, and small commercial properties. Conversely, higher tax rates would be imposed on properties that do not qualify for these breaks. While state leaders acknowledged that full implementation of the homestead rates wouldn’t be possible this year, they proposed interim tax rates for the first year, alongside a one-time rebate of up to $400 for qualifying taxpayers.

The bills sparked intense debate on the floor. Rep. Jane Gillette, R-Three Forks, voiced strong opposition, arguing that the policy had been decided before the session even began. “That cake was baked,” she said, lamenting that constituents would bear the brunt of what she described as a “stale, moldy piece of cake.”

In contrast, Rep. David Bedey, R-Hamilton, defended the measures, emphasizing the importance of providing as much relief as possible to as many Montanans as possible, despite the shift in tax burden. In the end, the House voted in favor of HB 231, passing it with a final tally of 60-39.

Later in the day, lawmakers in the House gave final approval to House Bill 2, the state’s $16.6 billion budget, which had been amended by the Senate earlier. This marked another key achievement for the session before the House officially adjourned at 12:58 p.m.

Meanwhile, the Senate’s session was delayed, with lawmakers convening later than scheduled at around noon. After the House returned from its recess, the Senate passed both SB 542 and HB 231, with final votes of 28-22 in favor of each bill.

The final piece of legislation under consideration in the Senate was Senate Bill 324, which proposed increasing the registration fee for vehicles valued over $150,000. While the bill had passed the House, it failed to garner enough support in the Senate, resulting in a 25-25 tie vote. Senate Minority Leader Pat Flowers, D-Belgrade, attempted to revive the bill with a motion to reconsider, but his efforts were thwarted by another tied vote. A second attempt to reconsider the vote was blocked, leading to a brief but dramatic moment just before the session’s conclusion.

With the Senate officially adjourning at 2:12 p.m., lawmakers closed the books on a session marked by both collaboration and contention. Though the property tax bills and state budget passed, the failure of SB 324 and the tense moments in the Senate highlighted the challenges faced by the legislature in the final hours. As the session came to a close, many lawmakers had already left the Capitol, bringing an end to the 2025 legislative session without any plans to reconvene in the near future.